The IAG share price has been a focal point for investors and financial analysts due to its fluctuating nature, influenced by market trends, economic factors, and company performance. International Consolidated Airlines Group (IAG) is a multinational airline holding company that owns major carriers like British Airways, Iberia, Aer Lingus, and Vueling. Given its global reach and operational complexity, its stock price reflects broader industry trends, economic conditions, and company-specific developments. Understanding the IAG share price helps investors make informed decisions, whether for long-term investments or short-term trades.

Historical Performance of IAG Share Price

IAG has witnessed significant ups and downs in its share price since its formation in 2011. Initially, the stock saw strong growth, reflecting the airline industry’s overall expansion. However, various factors have influenced its valuation over the years, including geopolitical tensions, economic slowdowns, and shifts in consumer demand for air travel.

One of the most defining moments for IAG’s share price was the COVID-19 pandemic. As global travel restrictions took hold, airline stocks, including IAG, plummeted dramatically. The company faced massive losses, prompting government intervention and strategic business restructuring. Post-pandemic recovery has been gradual, with the IAG share prices experiencing periodic volatility as passenger demand fluctuates and new challenges arise, such as fuel price increases and inflation concerns.

Factors Affecting IAG Share Price

Several factors contribute to the movement of the IAG share prices, ranging from internal company performance to broader economic conditions. Here are the key influencers:

1. Industry Trends and Passenger Demand

Airline stocks, including IAG, heavily depend on passenger demand. Economic recessions, global events, and shifts in travel behavior can directly impact the company’s financial health, thereby affecting its share price.

2. Fuel Prices and Operational Costs

Jet fuel costs represent one of the largest expenses for airlines. An increase in oil prices leads to higher operational costs, squeezing profit margins and impacting share prices. Conversely, a decline in fuel prices can boost profitability, positively affecting stock performance.

3. Macroeconomic Conditions

Inflation rates, interest rates, GDP growth, and currency fluctuations all play a role in shaping the IAG share prices. Strong economic growth usually leads to higher consumer spending, including travel, benefiting airline stocks. Economic downturns, however, reduce travel demand, negatively impacting stock prices.

4. Company Performance and Earnings Reports

Investors closely watch IAG’s quarterly earnings reports and strategic announcements. Strong financial results, new routes, fleet expansions, and successful cost-cutting measures can boost investor confidence, while disappointing earnings and operational challenges can lead to stock declines.

5. Competitor Actions and Market Positioning

IAG operates in a highly competitive market. Any strategic moves by competitors, such as pricing strategies, mergers, or new services, can influence investor sentiment toward IAG’s stock. If IAG successfully differentiates itself and strengthens its market position, its share price can reflect this positive outlook.

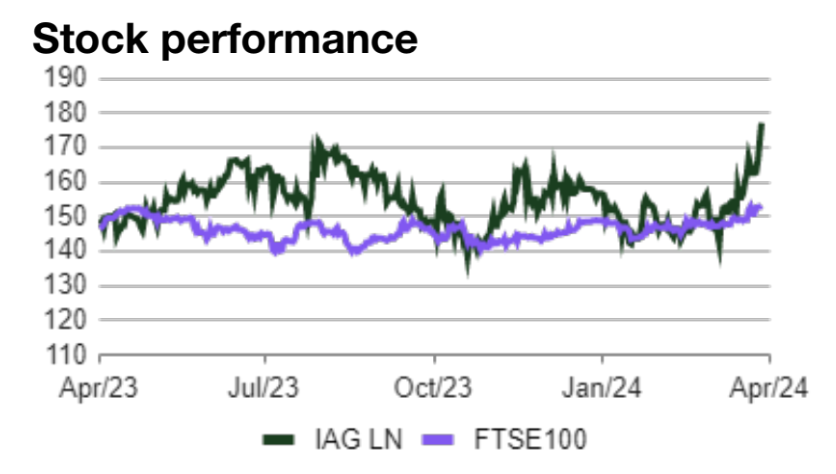

Recent Trends in IAG Share Price

Post-Pandemic Recovery

The airline industry has been recovering from the devastating impact of COVID-19, and IAG has been at the forefront of this resurgence. As restrictions eased, air travel demand rebounded, contributing to a gradual recovery in the IAG share prices. The company has focused on optimizing operations, increasing profitability, and expanding services to regain investor confidence.

Impact of Inflation and Interest Rates

Recent global economic uncertainties, including rising inflation and interest rate hikes, have added new challenges for airline stocks. Higher costs for consumers and businesses may reduce travel spending, creating downward pressure on the IAG share prices. However, as inflation stabilizes, a more positive outlook could emerge.

Sustainability Initiatives and ESG Factors

Environmental, Social, and Governance (ESG) factors are becoming increasingly important for investors. IAG has committed to achieving net-zero carbon emissions by 2050, investing in sustainable aviation fuel and modernizing its fleet for improved efficiency. Positive progress on sustainability initiatives could attract long-term investors and support stock growth.

Future Outlook for IAG Share Price

Expansion and Growth Strategies

IAG is focusing on expanding its route network, modernizing its fleet, and enhancing customer experiences to stay competitive. These strategies could drive future revenue growth and positively impact the share price.

Potential Risks and Challenges

While growth opportunities exist, IAG also faces risks such as geopolitical tensions, regulatory changes, and possible economic downturns. Investors should consider these factors when assessing the potential movement of the IAG share price in the coming years.

Analyst Predictions

Market analysts have varied opinions on the future trajectory of the IAG share price. Some predict continued recovery, driven by strong passenger demand and improved financial performance. Others remain cautious, citing economic uncertainties and industry challenges.

Conclusion

The IAG share price remains a key focus for investors looking at airline stocks. Understanding the historical trends, market dynamics, and factors influencing its movement can help investors make informed decisions. While short-term volatility may persist, long-term growth prospects could make IAG a valuable stock for investors willing to navigate the challenges of the airline industry.

Read more: CNN Portugal Direto: Últimas Notícias em Tempo Real

FAQ’s Section

The IAG share price fluctuates daily based on market conditions. Investors can check real-time stock data on financial news platforms or stock exchange websites.

Key factors include passenger demand, fuel prices, economic conditions, company performance, and competitor actions.

IAG’s share price has shown signs of recovery as air travel demand rebounds, though it remains volatile due to economic uncertainties.

IAG’s long-term potential depends on industry growth, strategic decisions, and market conditions. Investors should conduct thorough research before investing.

IAG’s commitment to net-zero emissions and sustainable aviation fuels may attract ESG-focused investors, potentially supporting stock performance over time.