Every year, millions of UK taxpayers may overpay tax due to changes in their income, tax code adjustments, or employer errors. The HM Revenue & Customs (HMRC) reviews these discrepancies and issues tax refunds when applicable. If you’ve received a P800 tax calculation letter, you might be eligible for a refund through gov.uk/p800refund. This official government portal helps taxpayers claim their refunds quickly and securely. Understanding the process ensures you don’t miss out on the money you’re owed.

What is a P800 Tax Refund?

A P800 tax calculation letter is a document sent by HMRC when they determine that you have paid too much or too little tax in a given tax year. If you have overpaid, the letter will inform you of the refund amount and how you can claim it through gov.uk/p800refund. Conversely, if you owe tax, the P800 will explain how to pay it back. It’s crucial to verify the details in your P800 to ensure its accuracy before taking any action.

How Does HMRC Calculate Your Tax Refund?

HMRC calculates tax refunds based on income details, tax codes, and benefits received throughout the tax year. Here’s how they determine if you are due a refund:

- Reviewing PAYE Information: HMRC gathers data from employers, pension providers, and other income sources.

- Comparing Tax Paid with Tax Owed: They check how much tax was deducted versus the actual tax liability.

- Identifying Overpayments: If more tax was deducted than necessary, a refund is issued.

- Issuing a P800 Letter: HMRC sends a P800 letter explaining the tax calculation and refund process.

How to Claim Your Refund Through gov.uk/p800refund

If you receive a P800 tax calculation stating that you are owed a refund, follow these steps to claim it securely through the gov.uk/p800refund portal:

- Wait for Your P800 Letter: HMRC only issues refunds based on P800 letters. Do not claim without receiving one.

- Visit the Official Website: Go to gov.uk/p800refund and follow the instructions provided in the letter.

- Log in Using Government Gateway: Use your credentials or create an account to access your refund.

- Confirm Your Details: Verify your personal information and bank details.

- Request Your Refund: Choose your preferred refund method—direct bank transfer (quicker) or a cheque (which may take longer).

- Receive Your Refund: Bank transfers usually take up to five working days, while cheques can take a few weeks.

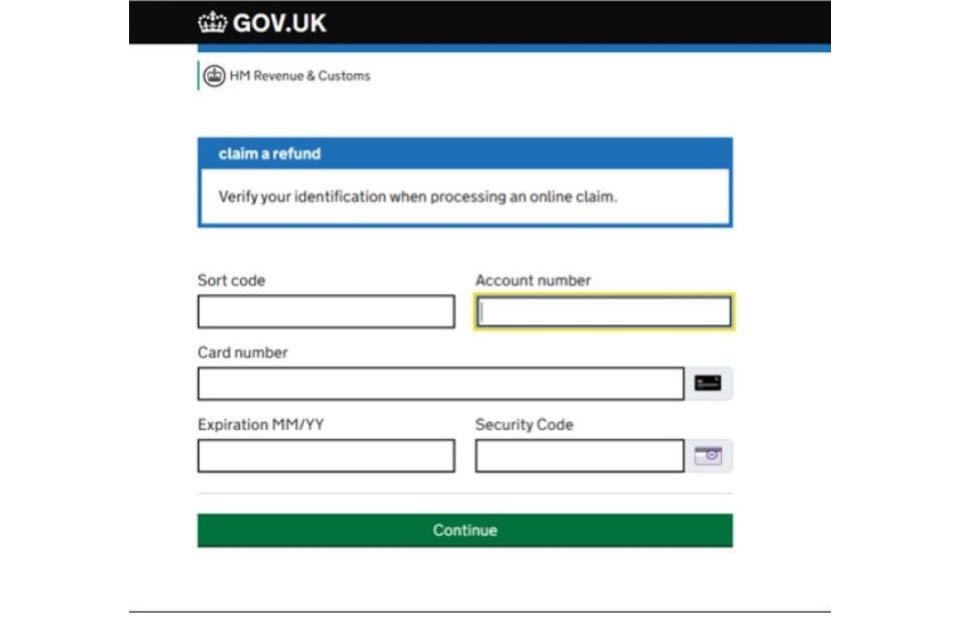

Avoiding Scams Related to gov.uk/p800refund

Scammers often target individuals expecting tax refunds by sending fraudulent emails, texts, or calls pretending to be from HMRC. To protect yourself:

- Check the Official Website: Only claim refunds through gov.uk/p800refund.

- Ignore Suspicious Emails and Texts: HMRC never asks for personal or financial details via email, text, or social media.

- Look for Official HMRC Communication: P800 letters are sent by post, not digitally.

- Verify with HMRC: If unsure, contact HMRC directly using their official helpline.

Who is Eligible for a P800 Tax Refund?

You might be eligible for a refund through gov.uk/p800refund if you:

- Had multiple jobs or income sources in a tax year.

- Were on the wrong tax code.

- Had an emergency tax code applied to your salary.

- Overpaid due to employment changes (e.g., switching jobs or redundancy).

- Did not claim tax reliefs you were entitled to.

However, if you file a Self-Assessment tax return, your refund is processed differently, and you won’t receive a P800.

What If You Don’t Receive a P800 Letter?

If you believe you overpaid tax but haven’t received a P800 letter, take these steps:

- Check Your PAYE Tax Records: Review your tax deductions through your HMRC account.

- Use the HMRC Tax Checker: This online tool can help determine if you overpaid tax.

- Contact HMRC: If you suspect you are due a refund but haven’t received a letter, reach out to HMRC directly.

Time Limits for Claiming a Tax Refund

Taxpayers have up to four years from the end of the tax year to claim a refund. For example, for overpaid tax in the 2020/21 tax year, the deadline to claim is 5 April 2025. Failing to claim within this period means losing your refund entitlement.

Common Issues and How to Resolve Them

- Incorrect Refund Amount: If you believe the refund amount is incorrect, contact HMRC with supporting documents.

- Refund Not Received: If your refund has not arrived within the expected timeframe, check your bank details or contact HMRC.

- Lost P800 Letter: If you misplaced your letter, log into your HMRC account to check your tax records or request a copy.

- Refund Claimed by Someone Else: If you suspect fraud, report it to HMRC immediately.

- HMRC Requested Repayment Instead of Refund: Double-check your tax records to understand why you owe tax.

Conclusion

Understanding and claiming a tax refund through gov.uk/p800refund is crucial to ensuring you receive the money owed to you. Always verify the details in your P800 tax calculation, follow the secure online process, and stay alert to scams. If you believe you overpaid tax but haven’t received a P800, take proactive steps to check your records and contact HMRC. By staying informed, you can navigate the tax refund process confidently and efficiently.

Read more: HMRC to Fine UK Households £100 for Late Self-Assessment Tax Returns Starting January 2025

FAQ’s Section

gov.uk/p800refund is the official online portal where UK taxpayers can claim tax refunds if they receive a P800 tax calculation from HMRC.

Refunds usually take up to five working days if claimed via bank transfer, while cheques may take a few weeks.

Check your HMRC online account for updates, verify your bank details, and contact HMRC if there is a delay.

No, P800 letters are issued automatically by HMRC if you have overpaid tax. If you believe you are owed a refund, contact HMRC.

Always claim refunds through gov.uk/p800refund, ignore unsolicited emails or texts claiming to be from HMRC, and never share personal details with unknown sources.